Corporate and foundation research is different from individual research. Could it be so simple? About as simple as stating that boys are different from girls! They are different, but also the same in many ways. It’s complicated! Let’s take a quick peek at how corporate and foundation prospects differ when we need to identify new prospects or prioritize a long list.

Corporate and foundation research is different from individual research. Could it be so simple? About as simple as stating that boys are different from girls! They are different, but also the same in many ways. It’s complicated! Let’s take a quick peek at how corporate and foundation prospects differ when we need to identify new prospects or prioritize a long list.

Identifying Corporate and Foundation Prospects

There are some great tools out there for creating a good list of corporate and foundation prospects. Foundation Center Online and Foundation Search immediately come to mind. Pretty quickly you can create a long list of good prospects that fit some general criteria. Unlike individuals, many corporations and foundations don’t require a deep, personal connection to make a substantial gift.

And yet many times when you start digging deeper to craft your proposal, you realize that the prospects on your list aren’t as good a fit as you originally thought. For example, maybe they are listed as giving nationally but have only ever made gifts in Pennsylvania and Delaware. Or maybe they give to education, but only scholarships and not program.

Early on in my Aspire Research Group LLC career I was not interested in generating corporate and foundation prospects lists. There were plenty of grant writers around who could do that very well – and write the grants too!

But later on I started getting calls from people who had received a long and very broad list from a consultant or sourced the list themselves using products like Foundation Center Online. Now they were facing 100 or more prospects with no idea where to start and the pressure of meeting a fundraising goal.

When it comes to individuals, there are some great tools for narrowing a list like this. We have wealth screenings, predictive modeling scores and often, some giving history to our own organizations. As the Giving USA research has made quite clear, individuals provide the clear majority of overall fundraised dollars and it’s not surprising that the industry has invested in developing great tools for individual prospects.

Nevertheless, corporate and foundation partners are important players for many reasons, not the least of which because they help us engage with the individuals they employ and sell services to. And starting with the letter “A” and working through to “Z” is rarely ever the best use of time and resources.

I wanted to help people prioritize their corporate and foundation prospect lists, but in a way that would give them a good return on investment. In other words, I needed a way to prioritize that wouldn’t take much time so I could charge less. So I got creative. Maybe you have done this too?

Simple Scoring Scores!

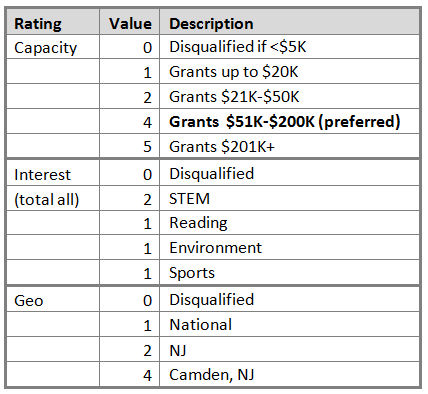

Whenever I take on a prospect ID or prioritization project now, I create a simple worksheet based on my first interview with the client. Then we walk through the worksheet together answering the questions about what a really good prospect should look like. A fundraiser might want a prospect who will give to a certain project, but I make sure we get specific.

“Gives to after-school education” becomes “Has made a gift to a similar initiative of $5,000 or more”. I will probably try to define “after-school education” more specifically too. Are we talking science, computer literacy, reading or all of them?

While we are going through the questions on the worksheet I might add or delete some of my questions as I learn more about the projects and needs. I also keep my ears open on which criteria are the most important. When we are finished with the questions I summarize and confirm which criteria are simply preferable and which ones will disqualify the prospect entirely.

An easy example is geography. If the foundation only makes gifts in New York City and the client organization is in New Jersey, the foundation is not a prospect.

The next step is to translate the worksheet answers into a rating legend. And by playing a little bit and giving some criteria extra weight – a higher rating value – I can get the prospects to sort out in a very obvious way based on the client’s funding needs.

By taking time up-front to determine what disqualifies the prospect and what is most important, I can zip right through the project. Doesn’t give where my client is located? Done with that one. Next!

All’s Well that Ends Well

Some of my prospect ID projects have gone stunningly well and others not so much. The difference has usually been the quality of communication with the client and how early I discover that what the client wants just doesn’t exist. I’m careful now to do an initial search and communicate quickly if I am struggling to identify prospects that meet the agreed criteria.

Your organization might have a straightforward relationship with corporate and foundation funders such as asking for a grant and getting a grant, or you might have many layers to your corporate and foundation relationships such as providing the funder with volunteering, cause-marketing, or fulfilling other needs.

If you are tasked with corporate and foundation research you know you have just as much opportunity to help create wonderful and rewarding relationships as with individual prospects. Maybe you have helped the frontline fundraiser connect with your organization’s vendors, sourced donor relationships with corporate foundation executives or leveraged your organization’s constituency in other ways to identify prospects.

However you do it, identifying corporate and foundation prospects is different from individuals. And as is usual when working with together with other humans, success often requires good communication matched with the creative application of skills!

Do you have a prospect identification success story? Have you heard about new technology solutions for corporate and foundation prospecting? I hope you’ll share with us!

Other Articles You Might Like

- Where Have All the Donors Gone by Mark Noll (2014)

- Research Alert: Corporate and Foundation Profiling is Easy! by Jen Filla (2014)

- Grant Seeking? Upping your Odds of Funding by Tracy Kaufman (2014)

When looking for foundations or corporations, I look at their giving history for the last 3-5 years, produce a spreadsheet from the FoundationSearch database and review it carefully. I mark giving that aligns with PATH activities and interests and present this to major gift officers and/or program staff. The spreadsheet usually contains recipient organization’s name, address and a short description of the grant. It is sorted by the size of the gift. I mark relevant gifts with a highlight and then group them at the top of my report. I look for similar information in NOZA for corporate giving.

That sounds like a great approach Olga! I like that you deliver the spreadsheet too, instead of reformatting. These days no-one should be in fear of or not know how to open and read a spreadsheet. Thanks for the comment and wishing you much more happy hunting!