I get it. Your organization is not going to ask for millions even if the prospect could give millions, so why should you spend your limited emotional energy trying to understand HNWIs (high net worth individuals) and global wealth trends? The clear majority of nonprofit organizations in the U.S., around 80%, have operating budgets of $1 million or less.

I get it. Your organization is not going to ask for millions even if the prospect could give millions, so why should you spend your limited emotional energy trying to understand HNWIs (high net worth individuals) and global wealth trends? The clear majority of nonprofit organizations in the U.S., around 80%, have operating budgets of $1 million or less.

Nevertheless, there are three very good reasons why you should care.

1-Mission

I’ve been a consultant for over a decade and no matter what the mission, every organization is sure that fundraisers with a different mission – children, animals, environment – have it easier. That somehow someone else’s mission is easier to raise money for. The truth is that every mission has passionate donors, but it takes careful, skilled fundraisers to understand the donor base and position the messaging and gift opportunities to match.

Sure, you might not have the budget or opportunities to attract million dollar gifts now, but isn’t your mission worthy of receiving million dollar gifts? Aren’t you working together with leadership to grow your organization’s impact?

If you don’t know anything about HNWIs how could you possibly position your organization’s messaging and gift opportunities to grow into million dollar giving?

2-Career Growth

Especially if you are working for a small nonprofit on a thin budget, you need to be in command of your career training. With rampant content marketing your free learning choices can be a bit overwhelming. You’re reading this blog post so I know you care about sharpening and growing your skills. The next step is to find and manage learning sources that are related, but outside the boundaries of fundraising.

Local and global economics, including HNWIs should be on your list. Following are three really good (and very readable) resources with a hot tip from each:

Capgemini World Wealth Report

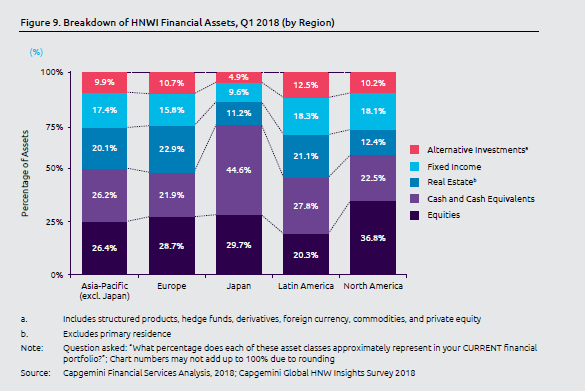

Besides having a fun-to-navigate website that lets you dig in to the data, you can download the report to take advantage of the table of contents and the executive summary. But it’s the attractive charts on pages 17-19 that I want to highlight for you here.

For the HNWIs that participated in this study in North America, 12.4% of their wealth is held in real estate. This percentage is excluding the primary residence, which is helpful because individuals who own multiple properties are more likely to be HNW. We don’t want to use our “back of the envelope” calculations on just anyone – only those that have investable assets of at least $1 million.

So, if you have someone who has multiple properties you can now perform some eye-opening “back of the envelope” calculations:

Real Estate ÷ 0.124 = Estimated Net Worth

Estimated Net Worth x 0.05 = Low Gift Capacity

Estimated Net Worth x 0.10 = High Gift Capacity

The New York Times – How to Get the Wealthy to Donate

Did you miss this article on “How to Get the Wealthy to Donate?” Did you hear about the underlying scientific research anywhere else? If not, you may find yourself frustrated and unhappy with the results of your conversations with HNWIs. It is squarely on your shoulders to understand and relate to donor prospects – in situ!

In this consumer-friendly world of content marketing, you don’t have to have a subscription to benefit from great resources like The New York Times. You can usually find a free e-newsletter or mobile app that will tease you with headlines. My favorite way of keeping up with multiple resources like this is to create a Twitter stream in Hootsuite of various topic lists I create from Twitter accounts that I follow.

Indiana University Lilly Family School of Philanthropy – Current Research

At Indiana University’s School of Philanthropy, the list of research projects creates a wonderful feeling of abundance! From Giving USA to the Study of High Net Worth Philanthropy to Women Give you can’t go astray.

“Nonprofit boards that include a higher percentage of women tend to have board members who participate more in fundraising and advocacy. Members of these boards also tend to be more involved in the board’s work, new research shows.” –Indiana University

The next time you attend a strategic planning session or any other leadership meeting, you now have scientific research at your fingertips to help your organization continue to grow and expand its reach.

3-Success = Preparation x Opportunity

Notice how I changed the formula adage slightly from “Preparation plus Opportunity” to “Preparation multiplied by Opportunity”? I wanted to emphasize how rare and transformative Opportunity is in this world. According to the Urban Institute, as of December 2016, there were more than 1.2 million public charities and private foundations in the United States. That is a lot of noise! How will donors and prospects hear you?

When opportunity does come, will you recognize it?

Are you prepared to seize it?

If you wanted to compete and win at the Olympics, would you wait until you passed initial qualifying tests before hiring a coach? No way! You would have had a coach from when you were a mere tot expressing interest. Don’t wait to get a fundraising mentor or coach. Regularly consume information about communicating with all kinds of people, including HNWIs.

Sales training abounds and one of my favorite resources is Sandler Sales. They have great white papers, articles, and newsletters. Do you have any kind of commute to the office? Visit www.sandler.com or search on iTunes to find their “How To Succeed” podcast, which is about 15 minutes per episode.

One of their recent episodes was how to make “touch calls.” This translates easily to fundraising! After all, we want to retain our donors and becoming more systematic about it is part of the preparation that leads to success. In the episode there is a reference to the DiSC profile and how each client personality is likely to respond to your call, which you might decide to investigate further.

You can create a personalized coaching team by pulling together key resources, like a podcast, and having the discipline to schedule time every day to learn.

Why am I focusing on Wealth instead of Philanthropy?

It is easy to argue that if you needed to focus on only one thing, it should be philanthropy first. After all, a person can have great wealth and refuse to part with a penny. Hands down, if you are in a smaller nonprofit, focusing on philanthropy first is a winning strategy. I’m not suggesting otherwise.

What I am suggesting is that it is important to focus on philanthropy with wealth. Your organization needs dollars and is worthy of money to pay the electric bill, hire competent staff, and deliver programs that are making our world a better place.

It’s important for all of us to assess our feelings about money and any bias we may have about wealth accumulation so that we don’t neglect our education and skill building around philanthropy with wealth.

Additional Resources

- Philanthropy and Wealth Reports Link List | Prospect Research Institute

- Four Best Practices for Salespeople That Turn Emails into Phone Discussions | Sandler Sales

- The New York Times – How to Get the Wealthy to Donate

- Indiana University Lilly Family School of Philanthropy – Current Research

- Capgemini World Wealth Report

“I need a profile on this person today…can’t you just Google it?” It’s the kind of question that makes prospect research professionals cringe. But why shouldn’t a development officer want it faster, better, and cheaper? Why is your organization paying thousands of dollars a year for research tools if it still takes forever to get the information needed?

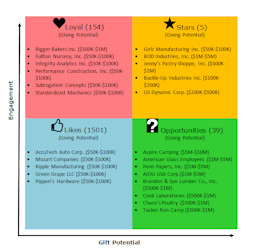

“I need a profile on this person today…can’t you just Google it?” It’s the kind of question that makes prospect research professionals cringe. But why shouldn’t a development officer want it faster, better, and cheaper? Why is your organization paying thousands of dollars a year for research tools if it still takes forever to get the information needed? In this wonderful era of exciting, off-the-shelf prospect research tools and one-click-away data analysis, how is it that we still struggle to prioritize our donors and prospects? But we do. The results come in, the scores are assigned and yet there are still way more highly-rated prospects than our staff could possibly contact. Which names do we call on first?

In this wonderful era of exciting, off-the-shelf prospect research tools and one-click-away data analysis, how is it that we still struggle to prioritize our donors and prospects? But we do. The results come in, the scores are assigned and yet there are still way more highly-rated prospects than our staff could possibly contact. Which names do we call on first?

Gift capacity ratings were a marketing moment for wealth screening companies. Suddenly thousands of records could be matched individually to wealth records and assigned a score. Your constituents could be assessed by their potential capacity – in the form of dollars. And everybody loves money. Have gift capacity ratings lived up to the hype? Yes!

Gift capacity ratings were a marketing moment for wealth screening companies. Suddenly thousands of records could be matched individually to wealth records and assigned a score. Your constituents could be assessed by their potential capacity – in the form of dollars. And everybody loves money. Have gift capacity ratings lived up to the hype? Yes! There was a cry for help on the PRSPCT-L list-serv: “I’m a new researcher and my boss wants me to provide net worth on a prospect. He says it was the previous practice to do this and I can get what I need to calculate it from Dun & Bradstreet.” What would your response be?

There was a cry for help on the PRSPCT-L list-serv: “I’m a new researcher and my boss wants me to provide net worth on a prospect. He says it was the previous practice to do this and I can get what I need to calculate it from Dun & Bradstreet.” What would your response be?