If you don’t want to be replaced by an algorithm, don’t do the work of an algorithm.

Tim Olivieri

That seems obvious, doesn’t it? But reality can be confusing. Should a prospect research professional be spending so much time doing the “hunt and gather” profile when the software tools are becoming progressively better at that hunting and gathering?

It depends.

It depends? That’s what consultants say to rationalize a higher price tag. Or is it?

If you asked Tim Olivieri, member and presenter at Apra Greater New York’s ProspectCon about it, he might argue that we should behave like consultants within our organizations, filling the gaps – in leadership, in information, and in all of our areas of expertise.

Could there be any “gaps” left having to do with the profile?

Imagine you are planning your campaign. It’s big and ambitious. The consultant is telling you that you’re probably not ready, but you can feel that the time is now. Your gut says you have the prospects to pull this off. You gather your top names and start building your strategies.

You have the automated information and ratings, but you know these people personally as part of your local community. Maybe some are long-since retired. Maybe some are pretty private. What you need is a deep look at them. Where do you turn?

Really good prospect research, that’s where!

Once we researchers know what you are trying to accomplish – “I think she could give $50M if motivated; she has five rescue dogs that get to roam her estate” – we get to work unraveling the wealth indicators, and collecting clues about her philanthropy, especially any similar relationships with other organizations.

At Aspire Research Group, our top-level profile is called a Strategic Assessment and it’s expensive. We spend anywhere from 7 to 10 or more hours crafting these masterpieces. It’s custom research.

It’s a thrilling mystery to solve and the impact of really good research is immediate. Delivering a masterpiece creates fabulous discussion. I’ve heard clients say things such as…

“This really gives me the confidence to ask for that amount.

“We had no idea they had a son and that he was also involved in their philanthropy.

The gap we fill with custom research is fundraising strategy. And it takes a different skill set than short profile research.

As you might expect, strategic research takes high-level wealth research skills. Understanding how people accumulate and hold their wealth means you can recognize and interpret the indicators or clues. It takes time, practice, and a lot of reading to develop these skills.

It also takes a different approach to the research. Instead of checking off boxes or filling in a template, this research calls for following every relevant clue. It may surprise you, but this is much more difficult for a prospect research professional to do these days, for two reasons.

First, it’s tough to switch gears to detailed research. Once you’ve been in the groove of churning out quick research reports, it can be tough to shake the feeling that it’s not worth the effort to untangle a public company insider’s derivatives or perform a range of searches on every single real estate address found.

Second, if you don’t have a strong understanding of fundraising and philanthropy, especially major gifts, you don’t know which bits of information you find are truly relevant. I’ve been reviewing other researcher’s work for many years now and usually they find all the important items – but don’t include them in the profile. Why?

I haven’t done any rigorous research on the question, but I can make some good guesses. Researchers are often separated from the frontline development officers and don’t know what it’s like to visit prospects. Continuing education is heavily focused on research skills, often without the complementary fundraising knowledge. Too many times the research education just doesn’t put the new knowledge and skills in the context of fundraising.

And the ratio of researcher to gift officers can be overwhelming. When one researcher is assigned to 20 or more officers, switching into survival mode can be necessary. Where could there possibly be time for 10+ hours on one prospect?

And yet… spending 10 hours on a prospect who will probably make a $50 million gift is a GREAT use of time. Pondering donor motivations and interests and spending time discussing strategy with the development officer is something no algorithm can do.

We want to be efficient and keep costs down. We want performance metrics, such as number of prospects identified, that are easy to count.

But there are some pretty easy steps we could take to begin walking away from the algorithms. For example, we talk about presenting and training development officers about using research, especially as new hires. Good stuff.

What if we asked development officers to train us on moving a major gift prospect through the gift cycle?

That little step could possibly transform how you present all of your research, including profiles. You might begin using the same words as development officers. You might even re-format your profiles to meet their needs. They might seek your advice.

And then you can scratch your chin and say, “It depends.”

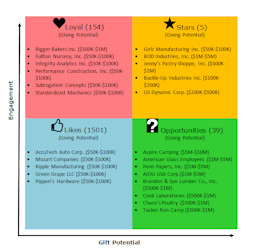

Imagine you emerge from a strategic planning session and your task is to raise more money from corporations. Your organization wants to expand its reach and you need to take the thousands of corporate donors in the database and transform them into a fundraising program. Why? Because everyone “feels” like there is a lot of opportunity there. Where do you start?

Imagine you emerge from a strategic planning session and your task is to raise more money from corporations. Your organization wants to expand its reach and you need to take the thousands of corporate donors in the database and transform them into a fundraising program. Why? Because everyone “feels” like there is a lot of opportunity there. Where do you start? “I need a profile on this person today…can’t you just Google it?” It’s the kind of question that makes prospect research professionals cringe. But why shouldn’t a development officer want it faster, better, and cheaper? Why is your organization paying thousands of dollars a year for research tools if it still takes forever to get the information needed?

“I need a profile on this person today…can’t you just Google it?” It’s the kind of question that makes prospect research professionals cringe. But why shouldn’t a development officer want it faster, better, and cheaper? Why is your organization paying thousands of dollars a year for research tools if it still takes forever to get the information needed? In this wonderful era of exciting, off-the-shelf prospect research tools and one-click-away data analysis, how is it that we still struggle to prioritize our donors and prospects? But we do. The results come in, the scores are assigned and yet there are still way more highly-rated prospects than our staff could possibly contact. Which names do we call on first?

In this wonderful era of exciting, off-the-shelf prospect research tools and one-click-away data analysis, how is it that we still struggle to prioritize our donors and prospects? But we do. The results come in, the scores are assigned and yet there are still way more highly-rated prospects than our staff could possibly contact. Which names do we call on first?

Two of the strongest characteristics prospect research professionals have in common is insatiable curiosity combined with a surprising boldness. We are proudly generalists! And very good at it too.

Two of the strongest characteristics prospect research professionals have in common is insatiable curiosity combined with a surprising boldness. We are proudly generalists! And very good at it too.

There was a cry for help on the PRSPCT-L list-serv: “I’m a new researcher and my boss wants me to provide net worth on a prospect. He says it was the previous practice to do this and I can get what I need to calculate it from Dun & Bradstreet.” What would your response be?

There was a cry for help on the PRSPCT-L list-serv: “I’m a new researcher and my boss wants me to provide net worth on a prospect. He says it was the previous practice to do this and I can get what I need to calculate it from Dun & Bradstreet.” What would your response be?

Did you have a chance to read the

Did you have a chance to read the