I thought it might be worthwhile (and fun!) to explore a well-known public company executive’s compensation package to illustrate a few of the many and creative ways executives are compensated. Sometimes I forget that the Wall Street world of finance and juicy executive compensation packages is a mystery to many, even in prospect research. My career began as a legal secretary and included editing proxy filings just as the Securities and Exchange Commission (SEC) transitioned to its electronic filing system called EDGAR. Filings can be tedious, but that’s partly because they are packed with information.

I thought it might be worthwhile (and fun!) to explore a well-known public company executive’s compensation package to illustrate a few of the many and creative ways executives are compensated. Sometimes I forget that the Wall Street world of finance and juicy executive compensation packages is a mystery to many, even in prospect research. My career began as a legal secretary and included editing proxy filings just as the Securities and Exchange Commission (SEC) transitioned to its electronic filing system called EDGAR. Filings can be tedious, but that’s partly because they are packed with information.

Public Company Insiders

Carol Meyrowitz is the president, Chief Executive Officer, and director of TJX Companies, which operates stores like T.J. Maxx, Marshall’s, and Home Goods. TJX Companies’ stock is traded on the New York Stock Exchange (NYSE) under the ticker TJX. Meyrowitz is both a top executive and a director, which qualify her to be a public company insider. If she owned 10% or more of the company’s stock, that would also qualify her. Any of those three roles qualifies someone as a public company insider.

For the most part, the only people who are required to report their stock holdings in public filings with the SEC are insiders. And when you stop to think about it, there are very few public company insiders compared to the large number of people who own stock. This means that many of your wealthy prospects who own substantial portfolios of stock will not be found in any SEC filings.

Incentive Plans in Public Companies

The SEC requires public companies to detail their compensation packages for top executives. Each company decides on its own how to reward executives for their performance. Especially since the 1970’s, theory has it that executives – and directors too – need much more than salary to keep them interested in the company’s success and achievements.

Below is a chart of Meyrowitz’ compensation in fiscal year 2013. We are going to walk through each type of compensation she received. Keep in mind that I am no tax expert! This is meant to be a big picture, brief explanation with tips on applying the information to fundraising.

|

Fiscal Year

|

Salary

|

Bonus

|

Stock Awards

|

Stock Option Awards

|

Non-Equity Incentive Plan Comp

|

Change in Pension Value & Non- Qualified

Deferred Comp Earnings

|

All Other Comp

|

Total

|

|

2013

|

$1,426,924

|

–

|

$10,872,000

|

$654,630

|

$6,050,370

|

$2,716,326

|

$48,550

|

$21,768,800

|

Salary and Bonus

Just like you and I, insider executives receive a salary, paid in cash, for doing their job every day. They might also receive a bonus based upon their job performance, which may also called a short-term incentive. Notice how Meyrowitz has not received a bonus in the past three years? The word “bonus” took a real beating during the recession. Even though she didn’t receive a bonus, there are still some really big numbers in her compensation package.

Stock Awards

Stock awards represent the value of the stock Meyrowitz was given by the company when they gave it to her. The idea is that when she meets her performance goals, she gets to share in the rising value of the company through its stock. There may be all kinds of confusing language around this. She might be given restricted stock that do not vest (become fully owned by her) unless she meets certain goals. And she might be required to own a certain number of shares of stock as long as she is an executive.

HOT TIP: Just because this stock awards number is high, it does not mean that all of the stock is available to her to gift or sell. Her salary, the paycheck she cashes just like you, is $1.4 million. Some or all of the $10.9 million stock awards could be untouchable.

Notice how stock is the biggest part of her pay package? That’s no accident. Cash payments are taxed as income. Stock is not. When Meyrowitz sells her stock she will pay capital gains tax on money she makes as a result of the sale (the gain). Can you guess which tax rate is likely to be higher – income or capital gains?

Stock Option Awards

Stock options give Meyrowitz the option to buy stock at a future date. These options are valued in the compensation table, but that dollar figure is more of an accounting mechanism and is not the current value.

The idea is that Meyrowitz will be more focused on the company’s financial improvement if she stands to make significant financial gains if the company’s stock price increases. So she is given an option to buy stock at a future date (the exercise date) at a locked-in price (the exercise or strike price).

For example, today she gets an option to buy 100 shares of stock at $70 per share. The stock is currently trading at $62 per share. If she buys those 100 shares today, she would have to pay $70 but could only sell them for $62. She would lose money! But if we give her options today as an incentive, we’re going to tell her she can’t exercise her options until next year. Now she has a year to get the company’s stock higher than $70 per share.

A year later, she can buy the 100 shares of stock for $70, and hopefully, the stock is trading at $71 or higher. She spends $7,000 and can turn around and sell them for $7,100 ($71 per share), earning $100 on the sale. When the exercise price is lower than the market price and she can sell at a profit, we say her options are in-the-money. If we turned it into a formula, it might look like this:

($market price – $exercise price) x number of shares = $value

($71 – $70) x 100 = $100

HOT TIP: When trying to determine if Meyrowitz might use her options to make a gift to my organization, I want to know when she will be able to exercise her options and if they are in-the-money. If she can’t exercise them yet or they are without value, we can’t get a gift.

Non-Equity Incentive Plan Compensation

Non-equity means that it is a non-stock incentive. For TJX Companies, this means it is part of its short-term cash incentive plan and its long-term cash incentive plan. So Meyrowitz receives cash for doing a good job in the current year, and even more cash if she keeps it up over a certain number of future years. It’s possible that she could get fired today and still be owed cash under the long-term incentive plan if the company continued to perform!

HOT TIP: You might be saying to yourself, “Cash incentive – isn’t that the same thing as a bonus?” Pretty much. But the word “bonus” has gone out of fashion.

Change in Pension Value & Non- Qualified Deferred Compensation Earnings

The IRS closely regulates retirement plans and there are many vehicles for stashing your cash for retirement. A pension is usually tied to the employee’s salary and years of service. I didn’t dig deep to find out details about Meyrowitz’ pension, but it’s in the SEC filings. Non-qualified money is money that does not receive tax-favored status from the IRS for retirement. Deferred compensation is owed but not paid to the employee until a later date, typically to reduce the amount of individual tax paid in a particular year. Changes in regulations have lessened its popularity.

All Other Compensation

These are the perks! And while some might seem extravagant to us ordinary folk, there are some good reasons behind a few. For example, having life insurance on a key executive provides a cash cushion if the company has to replace her on short notice. Very high-profile executives might need the personal protection a private jet provides. Below is a table from the SEC filing that gives us the detail behind the other compensation for Meyrowitz.

|

Automobile

Benefit

|

Reimbursement

for Financial

Planning and

Legal Services

|

Employer

Contributions or

Credits Under

Savings Plans

|

Company Paid

Amounts for Life

Insurance

|

Total

All Other

Compensation

|

|

$36,594

|

$5,940

|

$4,881

|

$1,135

|

$48,550

|

HOT TIP: Other compensation is not cash and that means it doesn’t factor in directly to the prospect’s ability to make a gift.

Your Top 5 Take-Aways

If everything else about executive compensation was confusing to you, I hope you at least come away with these nuggets:

- A public company executive’s total compensation is made up of many different items. The actual cash portion and number of shares of stock available for immediate gifting to your organization is likely to be much less than the total.

- The current incentive plan fad is to not pay bonuses, and sometimes not even to pay a salary at all (see Meg Whitman), but you can bet the executive still receives hefty compensation in the form of stock.

- Stock Options require the executive to shell out the cash to buy the stock first. The executive does not receive a profit unless she buys the stock at a discount and then sells it at the higher market price.

- Stock Options might have zero value if the company stock price has fallen.

- Other Compensation is not money available for gifting, even though it is reported as a dollar figure.

Do You Have a Proxy To Read?

Do you participate in a 401(k) plan at your work? Or maybe you own shares in a mutual fund. I hope this little bit of explanation has you really curious – curious enough to start reading some of the financial documents you receive in the mail. If you are new to SEC filings, the best one to read first is the proxy, also called SEC Form DEF 14a.

The proxy for TJX Companies is where I found all the information for this post. You can visit www.sec.gov yourself and look up that proxy online.

Do you have hot tips on executive compensation to share? Please add to the comments below!

Other Articles of Interest

Meg Whitman Agrees to Work for $1 – Or Does She?

US CEOs break pay record as top 10 earners take home at least $100m each

America’s Highest Paid CEOs

Did you know that major gift officers who use prospect research raise more than their colleagues who go it alone? Prospect research is the secret sauce that has been helping some organizations out-perform others for years. Think about it. Can you name a higher-education fundraising powerhouse that does not employ prospect researchers? When I was working on the book,

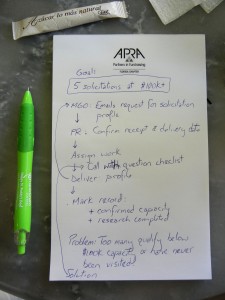

Did you know that major gift officers who use prospect research raise more than their colleagues who go it alone? Prospect research is the secret sauce that has been helping some organizations out-perform others for years. Think about it. Can you name a higher-education fundraising powerhouse that does not employ prospect researchers? When I was working on the book,  The secret trick to analyzing your donor information is to understand your fundraising fundamentals. Remember the fundraising pyramid?

The secret trick to analyzing your donor information is to understand your fundraising fundamentals. Remember the fundraising pyramid?