Let’s test your wealth instinct and find out if you “get it” or not.

Pretend that your boss comes to you and says: As you know, leadership is taking the company public next year. You can choose how you want to receive your $100,000 annual compensation from the three options below:

- $25,000 in cash and $75,000 worth of the company’s new stock

- $75,000 in cash and $25,000 worth of the company’s new stock

- $80,000 in cash and $0 worth of the company’s new stock

Which one do you choose?

This choice is difficult for you and me!

If the only wealth you have is cash in your bank accounts, maybe some retirement funds like a 401(k), and you are renting or own the home you live in(probably with a mortgage), your options are very limited. Could you survive on $25,000 cash for a year? You are considering the options based on your disposable income.

If you have a dual-income household, a second home, or some reasonably liquid investments that you could cash-in, all three choices might become plausible options. You have disposable income plus additional investment wealth.

I know you know that the $75,000 worth of stock could take off and double or triple in value-or even more. You want that stock!

Now, what if suddenly your parents passed away and you inherited the house they owned for 50 years, which sells for $800,000. Would that make it easier to accept $25,000 in cash with $75,000 in stock?

Of course it would!

And this is the shift in thinking that you need to make when you are researching and cultivating major gift prospects.

You do not want a cash gift.

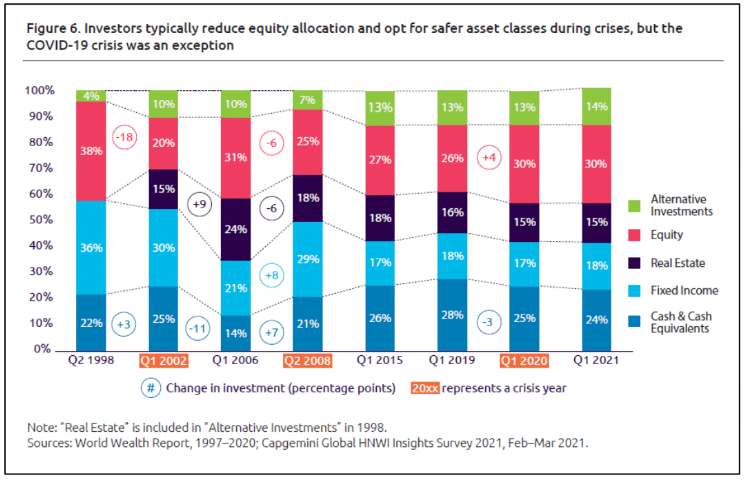

Check out the asset allocation chart below. This chart is telling you many things, but among them is that in the first quarter of 2021, the high-net-worth individuals (HNWIs) surveyed were holding 24% of all of their wealth in cash and cash equivalents. A cash equivalent is something like a certificate of deposit (CD) or money market account–things that you can very easily turn into cash.

When you ask your donor prospect for a gift, do you want her to think:

“Gosh, they want me to give $50,000 out of my $250,000 cash. That feels a bit steep. The kids private school tuition went up a lot this year.”

Or would you rather ask for a gift of appreciated stock and have her think:

“If I give $50,000 of appreciated stock out of my $750,000 investment account, I can take a charitable gift tax deduction for the full amount and offset the capital gains taxes. I’ve always wanted to have this kind of impact on this cause.”

But you shouldn’t just believe me.

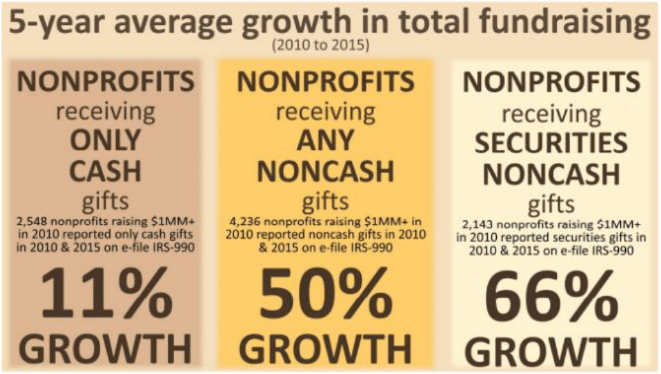

What do I know? Instead, you should believe Dr. Russell James who took the time to review a million nonprofit tax returns filed between 2010 and 2015. Numbers don’t lie. Dr. James discovered that nonprofits that received asset gifts raised more money. Check out the figure below for a snapshot of his findings.

Note: If you want to find whether your organization has a history of accepting asset gifts, you can check Schedule Min its public IRS Form 990.

Evaluating your donor prospects for wealth

If you want to grow your fundraising in major gifts, a key strategy is to ask for non-cash gifts. Understanding the asset allocation model from Capgemini featured above allows us to quantify this shift in thinking. We can now estimate the relative size of the cash vs. non-cash wealth held by our donor prospect.

Once you have estimated the value of the cash and non-cash wealth of your prospect, you can better understand how your prospect might view your ask amount relative to those values.

Below is an example of what this allocation looks like if we use the Capgemini asset allocation percentages on someone research has determined has an estimated net worth of $5 million.

| Assets | Value |

| Cash and Cash Equivalents | $850,000 |

| Non-Cash | $4,150,000 |

| Total | $5,000,000 |

Imagine for a moment that you want to ask the prospect for $250,000. How does that stack up against each of the two categories, cash or non-cash?

Lean-in to the psychology of giving

Why would you want to fight against human nature and continue asking very wealthy donors for cash gifts when you could switch to asking for non-cash and raise more money overall? Lots of reasons. Maybe you feel much more comfortable asking for cash gifts.

I’m suggesting that it’s time to get comfortable with being uncomfortable.

To help you get more comfortable, check out this collection of work by Dr. James for more insights into the psychology of giving and techniques and tactics you can use in your work:

http://www.protopage.com/prospectresearch#Planned_Giving_(Dr._James)