Finance Industry Series Part 1 of 5

For most of 2023 I plan to focus my blogging on the finance and investment industry. I wonder, is it the mystique of ruthless brainiacs in suits poring over financial charts and reaping millions, even billions that is so captivating? Once committed, I plucked the businesses that the Aspire team gets tripped up on the most in valuing for capacity, and felt as satisfied as taking a big bite of a street corner Philly pretzel.

But then I had to write this blog post, and, like Alice in Wonderland, I became curiouser and curiouser. Is the finance and investment industry really where the most money is being made?

Having found my rabbit hole, I began scampering down it. I decided to analyze the individuals ranked from 1 to 100 on the Forbes’ Billionaires List.

How Did Finance & Investments Perform on Wealth?

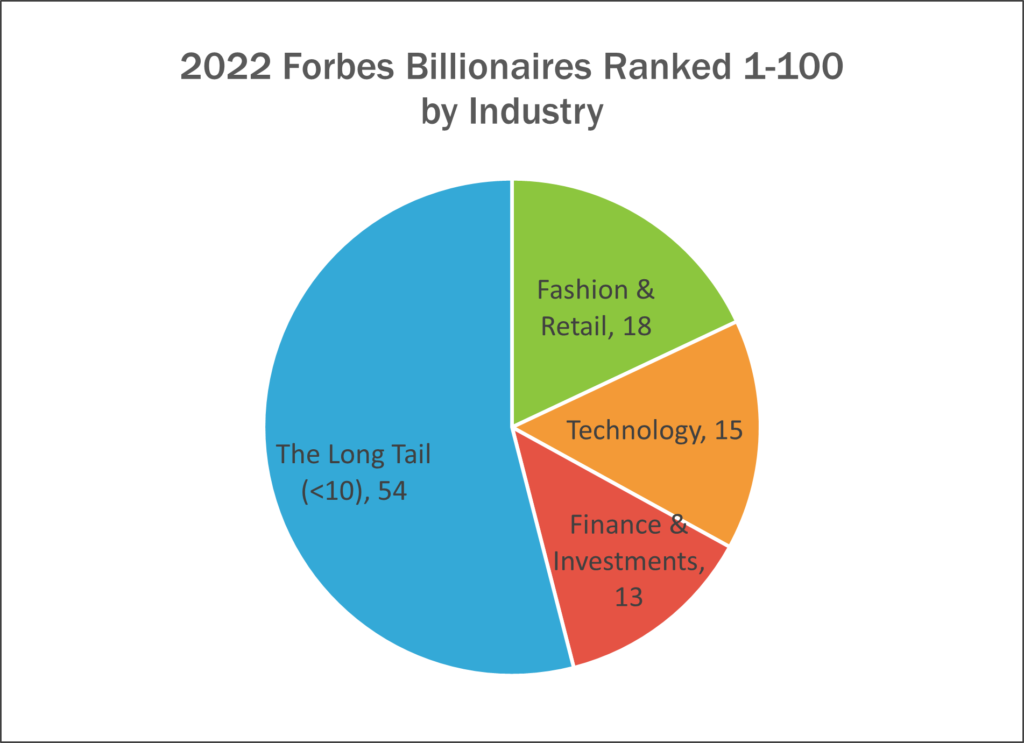

As you can see in the chart below, Finance & Investments came in as the third industry by count of billionaires. Would you have guessed that Fashion & Retail captured the most billionaires globally? Not me! I’m certainly willing to concede to the Technology industry, however.

Also, the top 100 billionaires globally are not exactly typical in the donor pool for any given nonprofit organization. Finance & Investments still ranks well with many high-earning potential prospects overall.

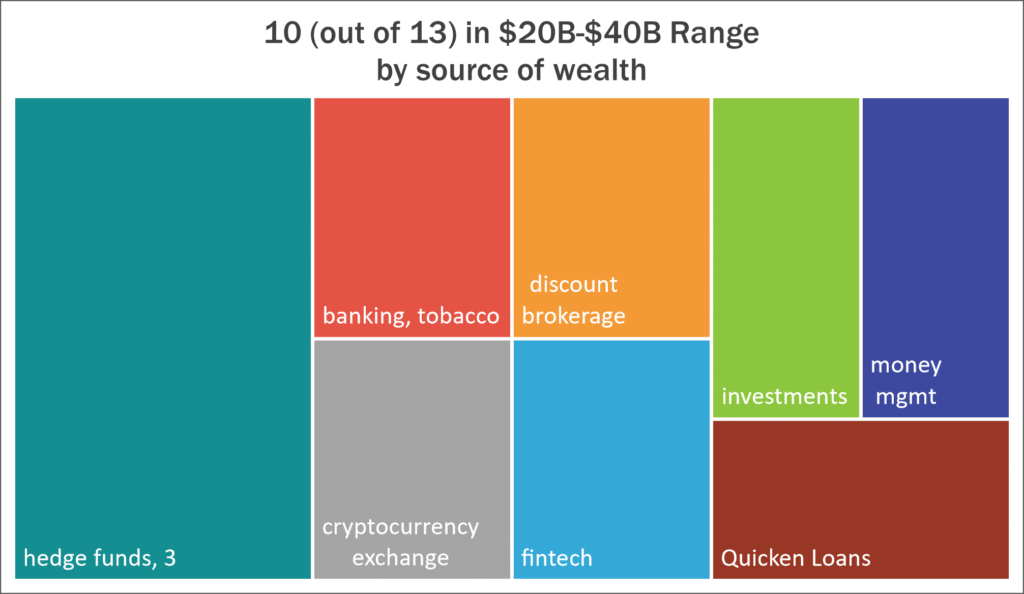

If we look at the 13 billionaires in the top 100 rank by estimated net worth (ENW), 10 out of the 13 in Finance & Investments fell in the $20B-$40B ENW range. It won’t surprise you that investor Warren Buffet ranked #5 on the Forbes’ Billionaires List with ENW of $100B+. And yet, there were 28 billionaires with ENW of $40B+ in the top 100 in other industries.

I know that I’m throwing around $20B to $40B like it’s not much, but I was really expecting the truly obscene net worth numbers to come from the Finance & Investments industry!

Did the Wealthy in Finance & Investments Give?

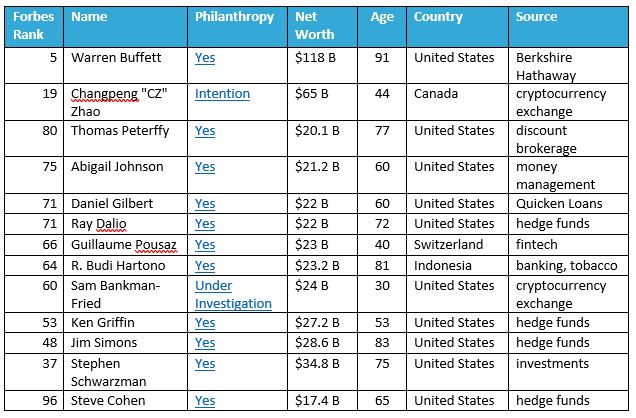

I was delighted to discover that all of them did. The ongoing investigations into Sam Bankman-Fried didn’t inspire me, but even when dollars are donated as a means of gaining or maintaining influence, philanthropic giving appears to be a must-have accessory at the top — and for some, truly a passion. Steve Cohen and his wife Alex created a foundation that has been giving to the community for 20 years.

Following is a list of all 13 on the 2022 Forbes’ Billionaires list that ranked between 1 and 100 with hyperlinks to some information about their philanthropy.

Mastering the Numbers

The finding that there is, indeed, a clustering of billionaires in the top 100 of the Forbes’ Billionaires list confirms that the Finance & Investments industry is a hot spot for wealth. I plan to write more about the Finance & Investments industry and philanthropy, looking specifically at the following businesses, which are also the subject of Master Classes at the Prospect Research Institute:

Hedge Fund | Private Equity | Venture Capital | Investment Advisors | Investment Banking

Click for the Master Class Schedule

The goal for the master classes on these business types is to give you the 101 overview so you understand HOW people in that business make money, helping you more accurately find and quantify the relevant information.

Because we researchers are a bit obsessed with the gift capacity rating! And it is a handy and familiar rating to help us segment and prioritize donors. But once we dive into verifying the electronically generated capacity rating, we often feel lost – especially within complex industries such as Finance & Investments.

When it comes to getting closer to the truth with gift capacity ratings, it’s all about your knowledge and intuitive skill, which is frequently lacking for the Finance & Investments industry. It’s difficult to master something you don’t have to do very often!

You probably won’t walk away from the Master Class popping out super accurate valuations faster than the 180 microseconds it takes to cover the 35 miles from NYSE to Nasdaq data centers. But you will gain some foundational knowledge, a little skill from the homework practice, at least one reference download, and a lot of cheerful camaraderie with your peers.

I hope to see you at a Master Class soon!

Additional Resources

- Top of the Wealth List: Finance and Investments? | Finance Industry Series: Part 1 of 5 | Jennifer Filla Blog | 2023

- Alternative Investments: Sophistication Required | Finance Industry Series: Part 2 of 5 | Jennifer Filla Blog | 2023

- The Simple Way to Spot Million-Dollar Donors In Your Database | Finance Industry Series: Part 3 of 5 | Jennifer Filla Blog | 2023

- Affinity First Or ‘Why Is My Prospect Not On The Forbes List?’ | Finance Industry Series: Part 4 of 5 | Jennifer Filla Blog | 2023

- Venture Capital, Private Equity, and Hedge Funds – Don’t hesitate to rate! | iWave Blog | 2023

Finance 5 Blog Series

- Top of the Wealth List: Finance and Investments? | Finance Industry Series: Part 1 of 5 | Jennifer Filla Blog | 2023

- Alternative Investments: Sophistication Required | Finance Industry Series: Part 2 of 5 | Jennifer Filla Blog | 2023

- The Simple Way to Spot Million-Dollar Donors In Your Database | Finance Industry Series: Part 3 of 5 | Jennifer Filla Blog | 2023

- Affinity First Or ‘Why Is My Prospect Not On The Forbes List?’ | Finance Industry Series: Part 4 of 5 | Jennifer Filla Blog | 2023

- Can you really turn words into bigger gifts? Yes! | Finance Industry Series: Part 5 of 5 | Jennifer Filla Blog | 2023